Thermos, Harmony, and Hermits

A Post-AI 2025 - 2026 Gift and Investment Guide

Approaching the new year is when we are all supposed to buy stuff for each other and rebalance our, um, “investment portfolios.” You laugh, but It turns out these can be done simultaneously. Anything worth giving as a gift is worth investing in, so pair each of your gift acquisitions with some kind of investment in that same product, company, sector, or individual creator (“have you mentioned our subscribe button?” -ed.). I know, it is a bit early for a gift buying guide. Christmas Eve isn’t for three days, but I thought you might want to get a head start this year. Always looking to maximize the Return on Gift and Investment, or ROGI (pronounced “Ro-Ghee”), here is the Official Twenty Five Twenty Six Gift Giving and Investing Guide.

Please note that none of the investment advice below should be considered investment advice.

The Thermos Vs. AI

It’s almost 2026, we need to capitalize on AI, so give and invest in a Thermos. When you pour hot coffee into a good thermos in the winter, it stays piping hot. When you put ice cold lemonade in a thermos in the summer, it stays cold. We can only marvel at the mug-like intelligence at work as we wonder, “How does it know?” They refuse to release their algorithm publicly but we can see the results in the product. It just works. Smartest. Cup. Ever. Strong buy.

Books: Physical, Actual, Paper, Books

After the AI industry collapses under the weight of being outsmarted by an insulated cup, the entire tech sector will struggle, likely resulting in massive losses and shutdowns of other digital media services. AI experts refer to this is the the “take my ball and go home” scenario, where the computer—the one that got bested by a coffee mug—is mad enough to take down Jeff Bezos’ entire Kindle and audiobook collection. Add to that the ongoing risk that old digital books get edited on the fly and released with unannounced changes, and the case for a heavy book on the shelf is even stronger. For an add-on investment, look into the emerging bookshelf and bookend markets for some early-stage start-up investment opportunities.

Music: Physical, Actual, Disturbance of the Air to Create Beauty

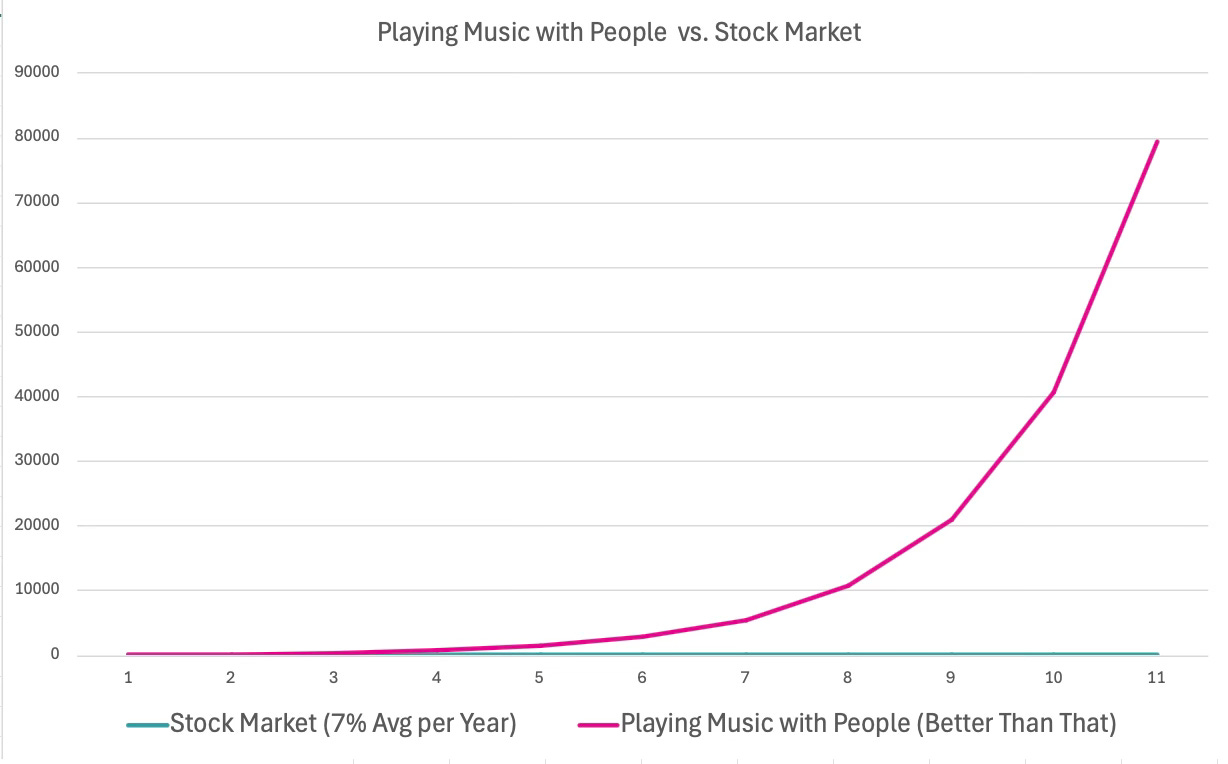

There is a move afoot to return to physical media for music, back to vinyl records and even (gulp) cassette tapes. This is a reasonable move. The same Anti-Intelligence forces that might drive Audiobooks into the ground could also create chaos in the music industry and turn Spotify into a single track, most likely ”Several Species of Small Furry Animals Gathered Together in a Cave and Grooving with a Pict,” on repeat. A change like that might be exciting at first but would get old around minute two. Vinyl records and cassette tapes have an appeal and a place in your music library, but our situation requires an investment strategy that is more medieval—Playing actual instruments with people in physical proximity to you. If playing the music yourself is out of reach, consider investing in a minstrel to travel by your side with a lute. Or consider directing your children to learn a variety of instruments and play them with little to no notice in public settings. At the very least, invite people over and encourage them to bring their instruments and be ready to play. This investment strategy has outperformed anything on the New York Stock exchange since its founding in 1792. The technical investment chart below presents this argument better than I can:

Subscription to Dad News Network

Sometimes the best investment (or gift) is paying for something that you already get for free. For example this newsletter. Most investment advisors advise against this. Why pay for something you already get for free? But that is exactly what all the investment gurus are expecting you to think. Use the element of surprise to your advantage—that’ll show ‘em. Also, a subscription could be given as a gift to an unsuspecting “friend.” Note the subscribe (or upgrade) button below. [Full disclosure, I am familiar with the founders and primary operators of this opportunity].

Hermits, Physical, Actual, Not-At-All-A-Joke, Hermits

The final way to capitalize on the current boom in apocalyptic AI scenarios is to run for the hills and become a hermit. If you flee to the wilderness, build a simple wooden (or stone) cell and spend 95% of your time in silent prayer, Skynet will still be able to find you, but it is unlikely to do so since the explosions and fires are much more dramatic when set in a city. You could build a series of these cells and invite friends to take vows of poverty and dedicate your life to the greater glory of God. If this sounds like, well, a lot of work—it is. The good news is that the work is already underway. It isn’t for everyone, of course (Dads are right out), but like aliens and the truth, it is out there. Here at Dad News Network, I have invested in the Discalced Hermits of Our Lady of Mount Carmel. Their schedule looks like this—and I am not making this up:

12:00am Rise

12:25am Pray the Divine Office together

1:45am Mental prayer

3:00am Sleep

6:00am Rise

6:15am Mental prayer

7:30 Pray the Divine Office together

8:15am Mass

9:15am Spiritual reading

10:00am Manual labor

1:00pm Pray Divine Office together, examination of conscience

1:30pm Dinner

2:30pm Rest

3:45pm Pray Divine Office together

4:15pm Study, classes, reading, labor

5:30pm Pray Divine Office together

6:00pm Mental prayer

7:00pm Meal

7:30pm Free time

7:45pm Reading

9:30pm Bedtime

They live alone in tiny buildings like this:

Perhaps the ultimate hedge investment, there is great comfort to be found knowing these men are living a life of radical simplicity and bringing our intentions to God in near-constant prayer. They also provide a source of inspiration and challenge to us, the gift-giving investor class. Their rejection of the world is so radical that it can serve as a prod for us to make a few sacrifices here in the messiness of our days. While it is difficult to calculate the Compound Annual Growth Rate of an investment when the total return is expressed in terms of Eternal Glory, after crushing some numbers, this one comes up as a slam dunk.

That concludes this year’s gift and investment guide. While your results may vary and past performance is no guarantee of future results, and with full acknowledgment that there are no get-rich-quick schemes, with these recommendations you can be sure of total success in a very short period of time.*

*This statement has not been approved by the Food and Drug Administration or any other regulatory body. Please do not submit it to any such regulatory body for review. Thank you.